The progress of technology has made many things possible for us, considering its influence is visible in every segment of life. In the case of finance, new technologies have enabled easy access to funds, smooth performance of money transactions, but also quick and simple loan applications.

It used to take days to go to your bank, file the application, and then wait for an answer. After that, there was an additional procedure and waiting for the money to become available. Luckily, that is a thing of the past now since most financial institutions and lenders enable digital loan forms, which significantly speeds up this process.

Many lenders today offer same-day loans, i.e., approval on the same day you apply. In this way, you can borrow from several thousand to several tens of thousands of dollars, with a repayment period that varies from lender to lender.

It mostly depends on the loan type (see here which types of these financial arrangements exist), borrowed amount, and your creditworthiness. If you’re interested in these financial arrangements, here is what you need to know before you apply.

Know How Loans on the Day Work

These financial deals don’t differ much from conventional arrangements. They can be long-term or short-term, with collateral or not, depending on your needs and possibilities and the lender’s assessment of your creditworthiness. Each of these deals can come with same-day approval; you just have to find a lender who offers that.

You apply for this loan through the lender’s website or in a branch. After you fill out the form and submit the necessary documents, the lender processes your request and, based on the assessed risk and your needs, sends an offer that would suit you best. You can accept it or not. If the offer suits you, lenders may ask for additional documents and verification, and after some time, the money will be in your bank account.

If you have applied for a same-day loan, lenders can be very efficient in processing your application. In case you send the application early in the morning, you can get an answer in just a few minutes. This efficiency means a lot when you need money urgently and want to know whether you can have it or not.

However, one thing should be clear – a same-day response doesn’t mean the money is available to you on the same day. This waiting period depends not only on the lender but also on your bank, which follows strict procedures around fast money disbursement. Most often, the money will be in your bank account in two days or, if you’re lucky, the next business day.

Determine Loan Eligibility

Each lender sets conditions under which conditions they will lend you money. These can be some general requirements, such as age, citizenship, and income, but they can also be more specific. For example, some lenders might only accept your application if your credit rating is good or excellent.

In Norway, most lenders require you to be of legal age, while some may raise the age minimum to 20 or even 25 years. Also, it’s necessary to be a resident or at least have temporary citizenship (or Norwegian D-number). You can apply for a loan as a foreigner if you have lived, worked, and paid taxes in Norway for at least three years.

As for your income, it should be sufficient to provide you with a comfortable loan repayment without putting you in financial difficulties. That’s why most lenders won’t borrow more than five times your annual income. Based on that, you can calculate how much money you can ask for.

If you meet these conditions, you can file the loan form. It’s a good idea to check these eligibility criteria because the lender will reject your application if you don’t meet at least one. So you’ll be left out of money, but your credit score will also suffer a hard inquiry.

Check Interest Rates and Fees

As said, loans with same-day approval aren’t too different from traditional consumer loans. The interest on them can be either high or low, depending on how much money you borrow, under what conditions, and whether the lender has assessed you as a more or less risky borrower. The better your credit rating, the greater the chance to get money with a low interest rate.

Interest rates on this type of loan can be as low as 6% and go up to 36% per year. These rates are generally higher on shorter-term unsecured arrangements. Still, some lenders can set interest rates over 50%. In Norway, the acceptable and affordable interest rate for borrowing money is around 12%.

In addition to interest, consumer loans with same-day approval also carry certain costs. Lenders charge for loan origination and application processing services, and there may be additional fees for early closing, late payments, etc. All of this should be taken into account when looking for the best deal for you.

Compare Offers

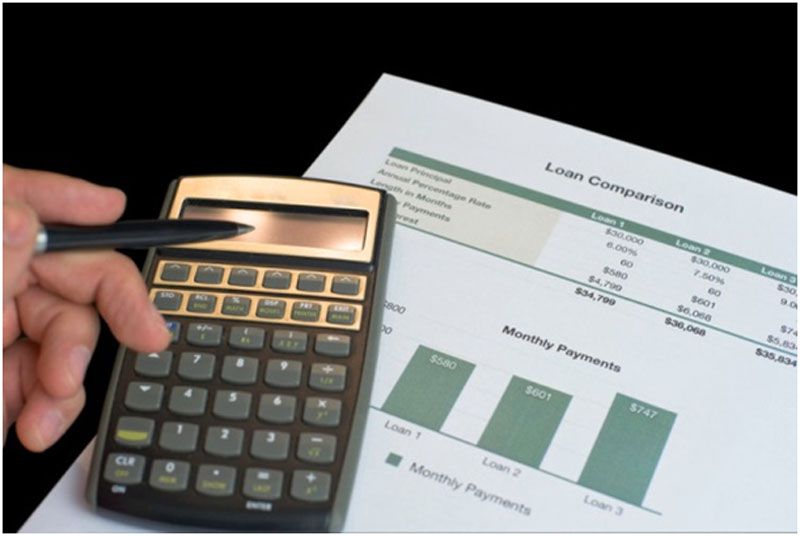

Regarding the fairly diverse offer of same-day loans, you should by no means rush to make a decision and accept the first deal that seems favorable. It’s always better to shop around because you have a better chance of finding what suits you. Of course, the possibility to compare several offers and their lending requirements is of great help.

When comparing loans, don’t just look at their parameters like interest and costs. These can tell you how much borrowing money will cost you, but keep in mind your personal preferences and financial goals, too. For example, if you want to borrow money and pay off that debt as soon as possible, you shouldn’t choose the loan with the lowest interest rate.

It may seem more affordable because the monthly installments are smaller. But this deal generally implies a longer repayment term, which makes it more expensive overall. Instead, go with a slightly higher interest rate and a shorter repayment period. If you can afford a bit higher installments, go for it. Due to the shorter repayment period, you’ll pay less in interest and save a significant amount of money compared to the previous offer.

Get Expert Help If Necessary

Researching and comparing deals can be much of a hassle if you’re not financially savvy. You can make wrong calculations or misunderstand some lending terms, which can lead you to choose the loan that’s not the best for you. And that can be a costly mistake.

In that case, you can hire a loan agent. They can collect dozens of loan offers, compare them, and present you with the best ones. Based on your credit score, they’ll look for the most favorable deals that meet your needs. That can save you a lot of time, you will get expert advice on what could be the best solution, and the best of all is that these offers are non-binding.

Benefits of Fast Loan Approval

A quick response to your loan application means a lot when you need money quickly. Whether it’s for covering unexpected expenses or meeting some basic needs, you can access these funds faster than with traditional loans. Also, the approval rate is higher, but that comes with a price tag.

The application procedure is quite simple, given that most lenders today operate online and enable digital application and submission of documents. Credit checks will also be fast, so borrowers can get an answer quickly, sometimes in less than an hour. Certainly, you can’t expect this if you apply for a loan at night or the end of the working day. But lenders will get back to you as soon as possible.

Borrowers usually søk lån på dagen when they need smaller amounts because these arrangements are unsecured, and you can usually repay them quickly. You don’t have to put any asset as a guarantee that you’ll return the borrowed money or get a co-signer as a backup. But this can be a viable option if you need a larger sum of money or a longer repayment period, or you have a payment note.

Are There Any Drawbacks of Same-Day Loan Approval?

The convenience usually comes with a price tag. Some same-day loans carry rather high interest, which can go up several hundred percent annually. Also, they may come with additional fees you should be aware of before accepting the offer.

A delay in repaying the same-day loan can get you into trouble. Apart from the fact that you’ll have to pay the entire debt plus the related interest, the lender may charge you late payment fees. That can not only have a bad effect on your finances but also damage your credit score for good.

Filling out the loan application and getting the response on the same day is great when you need to borrow money fast. With digital application, the entire procedure is fast and straightforward, so you can receive the lender’s answer on the same day and know what you’re up to.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.