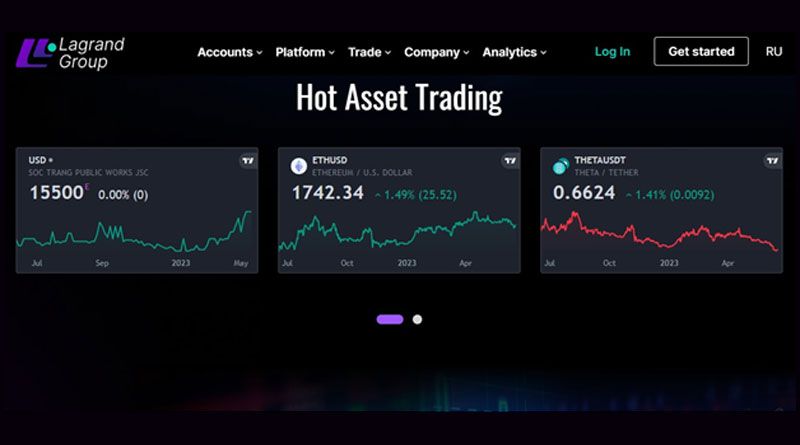

Foreign exchange (Forex), virtual currencies (cryptocurrencies), and fiat currency are only some marketplaces in which traders may participate. The proliferation of internet trading platforms like Lagrand Grouphas allowed regular people to participate in international markets without leaving their living rooms.

But you need more than access to these marketplaces to make you a successful trader. This essay will describe tried and true methods that have helped traders succeed in the difficult world of foreign exchange, cryptocurrency, and currency trading on Lagrand Group. Traders may improve their odds of making sound judgments and maximise profits by familiarising themselves with these tactics.

In-Depth Analysis of the Market on Lagrand Group

Conducting a thorough market study is a cornerstone of successful trading. Traders who want to succeed in the foreign exchange (FX), cryptocurrency (crypto), and currency (currency) markets should study the elements that affect them. Economic data, geopolitical developments, central bank policies, and technical analysis tools, including charts and patterns, are all explored in this research.

Fundamental analysis is helpful in foreign exchange trading because it may provide light on the state of various economies, interest rate differences, and political stability. Knowing the latest blockchain technology and regulatory and acceptance trends is essential in the cryptocurrency market. To find chances in currency trading, keeping tabs on macroeconomic data and central bank actions is necessary.

Controlling Dangers

Traders that are consistently successful also practice sound risk management. Stop-loss orders and take-profit orders are two trading aids made available by Lagrand Group. Setting reasonable risk-reward ratios for each transaction and sticking to them is crucial. Investors should only put up capital that they can afford to lose.

One of the most essential parts of managing risk is spreading it around. Traders should diversify their portfolios by investing in various assets or currency pairings rather than gambling on a single move. The risk of losing money on a single deal that goes against expectations is reduced by using this method.

Analytical Techniques

When making financial investments, technical analysis is crucial. To help traders spot trends, support and resistance levels, and entry and exit points, Lagrand Group provides several technical analysis tools and indicators. Traders may improve their trading selections by integrating technical analysis with fundamental and sentiment research of the market.

Moving averages, trend lines, Fibonacci retracements, and oscillators like the Relative Strength Index and the Moving Average Convergence Divergence (MACD) are all standard instruments used in technical analysis. Traders should study these resources so that they are comfortable using them in a variety of market environments.

Constantly Changing and Improving

Since the market is constantly changing, the most successful traders are the ones that are always eager to expand their knowledge and refine their methods. Traders may keep up with the newest happenings in the market with the aid of Lagrand Group’s instructional materials, webinars, and market research reports.

Participating in a trading community is another great way to get knowledge and encouragement. One’s trading prowess may improve by engaging in strategy discussions with and learning from other traders. Maintaining a record of your transactions allows you to look back at their results and see where you may have made mistakes.

Conclusion

Successful foreign exchange, cryptocurrency, and currency trading on Lagrand Group require using tried-and-true methods that facilitate well-considered decisions and prudent risk management. Critical components of a good trading strategy include thorough market analysis, risk management, technical analysis, and ongoing education. Traders may improve their odds of making a profit and having sustained success by combining these tactics and responding to ever-evolving market circumstances. Remember that trading needs self-control, persistence, and gaining insight from both wins and losses.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.