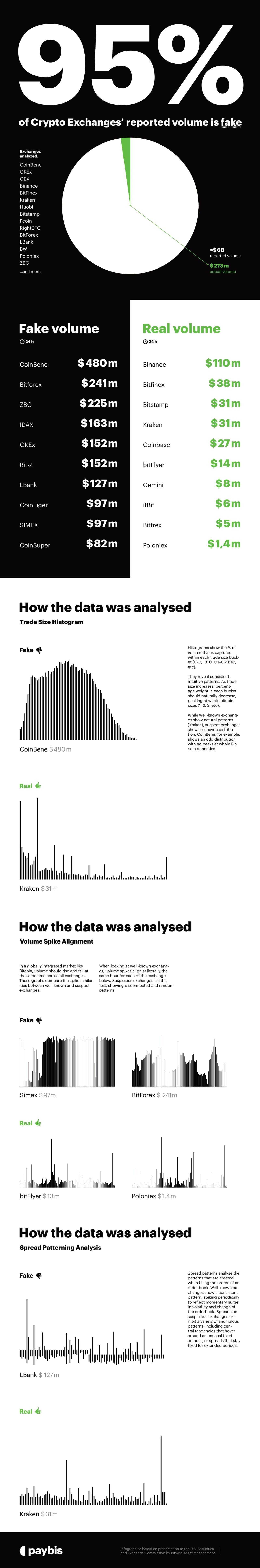

Just a few months ago, a very controversial document was released to the public. Bitwise’s 104-page research on cryptocurrency exchanges shook the waters of the crypto community.

In the document, the experienced authors used analysis methods to uncloak to analyze the deliberate inconsistencies linked with trading volumes.

Their findings were disappointing for the crypto community – Check the infographic bellow:

Why do exchange platforms report fake volumes?

Bitwise’s paper also analyses why cryptocurrency exchanges alter the information shown on their website. These can be summarized as follows:

- Top-list exchanges receive more attention from the media – Cryptocurrency exchanges preset inflated volumes to increase their popularity and gain new users, cryptocurrency exchanges present inflated numbers. This results in them rank on the top ranks of CoinMarketCap’s Exchange listing (by reported trading volume).

- Premium listing fees for ICOs and new Altcoins – Top-list cryptocurrency exchanges are able to charge much higher fees for listing new coins and hosting ICOs. This is because high volumes indicate a lot of trading activity. And with higher trading activity, coins have better liquidity.

Combating fake volumes in cryptocurrency markets

To deal with the issues, cryptocurrency tracker CoinMarketCap decided to add a new metric to help investors make better investment decisions.

The liquidity metric, which the platform added to its toolkit last November, allows visitors to check different exchange platforms based on their actual liquidity.

The introduction of this metric comes shortly after Carlylyne Chan, CoinMarketCap’s CSO, announced that they would look into the information of Bitwise and improve the transparency of the market.

Filtering cryptocurrency exchanges by their liquidity, helps get rid of misinformation created by such “unethical” platforms.

Despite the unpleasant discovery, Bitwise’s findings will lead to more transparency in the cryptocurrency world.

Regulatory frame of the crypto markets

From the 10 cryptocurrency exchanges that reported real trading volumes, 6 are based in the United States and possess a BitLicence.

This document, which is issued by the New York State Department of Financial Services (NYSDFS), gives them the ability to operate legally within the regulatory framework of the country.

The only platform (from the same pool) that is not registered as a money service business is Binance.

As you might have guessed already, regulatory oversight is now stronger than ever. In 2020, the Trump administration’s budget proposal plans to expand cryptocurrency oversight. These news may be met with some hesitation, as cryptocurrency is primarily seen as a private means of exchange.

However, it is important to realize that the state’s measures will also improve the reliability and transparency of existing and new cryptocurrency platforms.

The crypto market has matured

In late 2017, Bitcoin’s peaked at nearly $20.000 per coin. A price rally fueled by new, inexperienced investors who hoped to make quick profit, quickly turned into one of the worst bear markets in the history of BTC.

However, in 2018, the crypto market started to mature, with improvements being made in almost every subsector. The term “BUIDL” has gained popularity over the last two years, as crypto is now more mainstream than ever.

And sure, consumers are still fairly hesitant to invest, especially when considering the recent economic collapse caused by the Coronavirus.

However, institutional funds, governments, and countries are more involved than ever, trying to find ways to utilize the blockchain and develop state-backed digital currencies.

Bitwise’s report confirms this statement too. The document indicates that the Bitcoin market has matured a lot since its latest All-time-high.

One point that makes this visible is the constantly decreasing deviation of Bitcoin’s price in the exchanges that report real volumes. As a result, arbitrage trading is no longer profitable and the markets experience relative stability.

Closing thoughts

While fake volume incidents are decreasing, they are still a serious issue in the cryptocurrency markets.

However, Bitcoin has now proven to be a safe haven asset that is decoupled from other investment markets, which makes it a great long-term investment.

In crisis situations like the one we find ourselves in currently, small and irrelevant cryptocurrencies will perish. Scammy exchanges will no longer be able to profit from fakely inflated volumes. Most investors will slowly turn their focus on reliable and responsive cryptocurrency platforms that report their volumes in a transparent manner.

In time, cryptocurrency tracking websites like CoinMarketCap will improve their offer and add more filtering options, to show better metrics.

While exchange platforms and Bitcoin still have a lot of room for growth, there is already an ongoing effort being made, to improve the space for the better. And we believe that this trend will continue in the future.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.