In the fast-paced world of finance, options trading stands out as a versatile tool for investors seeking flexibility and strategic leverage. However, navigating the intricacies of options can be daunting, especially when it comes to assessing potential outcomes. This is where options calculators step in, serving as invaluable resources to analyze and evaluate various scenarios before making critical trading decisions.

Understanding Options:

Before delving into the specifics of options calculators, let’s grasp the fundamentals of options. In essence, an option is a financial contract that provides the buyer with the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specified timeframe. Options come in two primary forms: calls and puts.

- Call Option: Grants the holder the right to buy an asset at a predetermined price (strike price) before a specified expiration date.

- Put Option: Grants the holder the right to sell an asset at a predetermined price (strike price) before a specified expiration date.

Options traders navigate a myriad of factors including the underlying asset’s price movements, time decay, implied volatility, and more. The complexity amplifies when considering different strike prices and expiration dates. This is where options calculators become indispensable.

What is an Options Calculator?

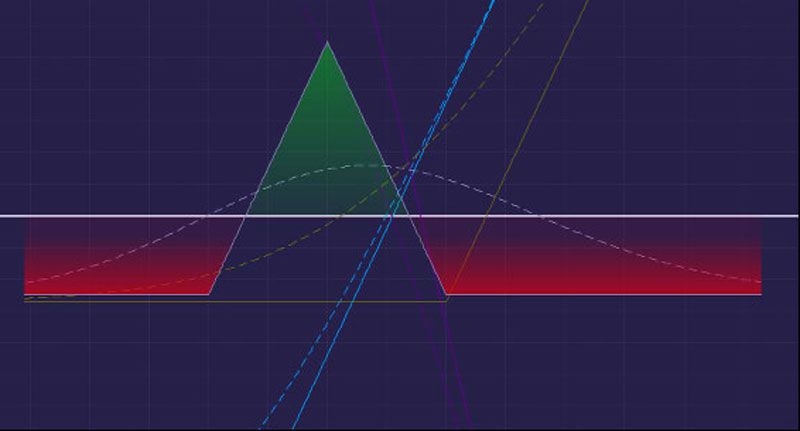

An options calculator is a powerful tool designed to assist traders in assessing potential profits, losses, and risks associated with specific options positions. These calculators use mathematical models and algorithms to generate estimated values based on input variables like underlying asset price, strike price, expiration date, and volatility.

Components of an Options Calculator:

- Underlying Asset Information: This includes details about the asset being traded—its current price, ticker symbol, and any dividends or interest rates associated with it.

- Option Type and Parameters: Users input whether it’s a call or put option, along with the strike price and expiration date.

- Volatility: Implied volatility measures the market’s expectations of how much an asset’s price will fluctuate. Options calculators incorporate this factor as it significantly impacts option prices.

- Risk-Free Interest Rate: This parameter is crucial in options pricing models like the Black-Scholes model, which considers the risk-free interest rate as a determinant of option prices.

Types of Options Calculators:

- Black-Scholes Calculator: Named after its creators Fischer Black, Myron Scholes, and Robert Merton, this model is one of the most widely used for pricing options. It considers various factors like underlying price, strike price, time to expiration, volatility, and risk-free interest rate.

- Binomial Options Calculator: This model uses a more discrete approach, breaking down time into a series of intervals and considering multiple possible price movements for the underlying asset.

- Monte Carlo Options Calculator: This method involves generating numerous random simulations of future prices for the underlying asset. It uses these simulations to estimate option prices.

Functions and Benefits of Options Calculators:

- Price Estimation: Calculators provide estimated option prices under various scenarios, aiding traders in assessing potential profitability.

- Risk Assessment: By displaying potential profit and loss scenarios, options calculators enable traders to assess and manage risks effectively.

- Strategy Testing: Traders can simulate different strategies by altering input variables, allowing them to optimize their trading plans.

- Implied Volatility Estimation: Some calculators also offer implied volatility estimation, aiding in understanding market expectations.

Practical Application:

Imagine an investor considering a call option on a tech company’s stock. By using an options calculator, they can input the current stock price, strike price, expiration date, and estimated volatility to determine the option’s potential profitability and risk. They can further adjust parameters to explore different scenarios and make informed decisions.

Limitations and Considerations:

- Simplistic Assumptions: Options calculators operate based on models with assumptions that might not always align with real market conditions.

- Dynamic Nature of Markets: Market conditions can change rapidly, impacting option prices differently from what calculators predict.

- Varied Model Accuracy: Different calculators use distinct models, and the accuracy of predictions may vary among them.

Conclusion:

Options calculators serve as indispensable tools for options traders, offering insights into potential profits, losses, and risks associated with various trading strategies. While these calculators provide valuable estimations, it’s essential for traders to combine this information with market analysis and real-time data for informed decision-making.

In the ever-evolving landscape of finance, options calculators stand as invaluable aids, empowering traders to navigate the complexities of options trading with greater confidence and strategic precision.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.