When a company sells products or services, invoices must be sent, and payments must be received. The value of invoice and payment processing rises in direct proportion with the business’s number of clients. Well, there are specific examples where companies are making profits but still suffering from poor cash flow and financial management. Nowadays, companies prefer to use technology and online billing software to simplify their invoicing and billing processes.

Billing systems and the use of best accounting software for business invariably significantly affect a company’s sales. More reliable processes ensure that businesses spend and get paying on time. Better liquidity protects businesses from cash crunches, which may cripple day-to-day activities.

This article will see exclusive steps and ways businesses can simplify and can excel if they implement them. Such as using online accounting software, POS billing software, and many other things.

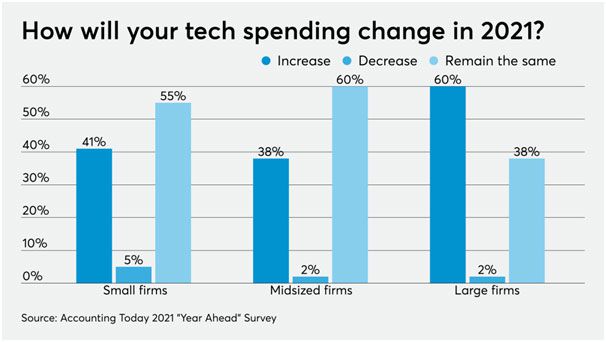

Change in Tech spending in the year 2021 (Source – AccountingToday)

The days are gone when companies used to rely on the manual accounting process. Now they are deploying a certain amount of technology. This is the statistic from the survey done by accounting Today.

Seven exclusive tips which will simplify invoicing and the billing process.

So, from where to begin as a business owner, to improve the consumer invoicing and billing method be improved? Let’s look at some tried-and-true guidance about where to go with your business invoicing and billing policy planning.

1. Reduce the reliance on paper.

You are doing yourself a massive disservice if you want to use a paper-based scheme. These invoicing relics are inconvenient, time-consuming, and easily lost. That is why you get online billing Software or POS billing software if you are a retailer with multiple franchises or into the restaurant business.

You will generate and submit professional-looking invoices to your clients electronically using an online invoicing software or application. That means they’ll reimburse you quicker, and you won’t have to send invoices and wait for a check through snail mail.

In a nutshell, best accounting software for businesses addresses all of the invoicing requirements in a single user-friendly dashboard.

2. Define the agreement’s terms.

As a small business owner, you can already understand the significance of contracts. You could be willing the odds of being stiffed if you do not have them.

No matter what business you work in, you and your customers can also negotiate terms of work. Such as the project’s expense, the duration of the project, how long the job will take, the kinds of fees you approve, the deposit rate, how many days the customer needs to pay until the invoice is submitted, and many more.

A contract not only covers you and the customer but also expedites the billing process. In reality, those who use invoice jargon are 1.5 times more likely to be billed on time than those who do not.

Generate invoices using online billing software and define your terms clearly to your clients. For more detailed information on business to business transactions, do refer to Unimaze’s guide on B2B invoicing.

3. Accept numerous payment methods.

You must be willing to receive payment from your clients in various forms, including credit card, check, and swift international wire transfer. It is essential to keep expiration dates and payment system information up to date while automating collections.

Automation may send out email updates (and upsell offers) weeks or months before a card’s expiration date. Providing various payment choices on your invoices will triple the odds of receiving payment by the due date.

The option to pay online is the most straightforward payment solution that you cannot overlook. Get an online invoicing software for your business that creates an invoice and should be integrated with multiple payment gateways to accept the payments.

4. Enhance the billing times

When it comes to invoicing, timing is all. It examined over 3 lakh invoices and discovered that most businesses invoice as soon as contracts started. Although invoicing after reaching a benchmark is beneficial, it may also be wasteful. If you are struggling to bill your client on time, get the best accounting software for businesses.

The following is the study’s main action points: –

- When you invoice once a week or every two weeks, start submitting invoices on weekends.

- If you bill monthly, start submitting bills on the first of each month.

You will significantly increase your cash flow if you follow these moves.

5. Get to Know the Customers

Understanding how the client performs can help you collect payments more quickly. Using this method, try to determine if your client is a legitimate individual or a forgery. Create the payment systems for your products or services until you’ve decided that you do have a specific customer.

Online billing software helps to collect such data of customers, their preferences. Still, it also gives the idea about accounts payable, receivable, crucial analytics, tracking of cost, and 100 other things, which is helpful to businesses in terms of managing finance.

Clarify payment forms, frequencies, and the length of time it would take to make the payment. You may even query them if they want to pay in lump sums or installments. By clarifying these facts, you will prevent unnecessary problems that might impede your success in the long term.

6. Trace late payments and go after them

Whether the clients fail to meet a date, you reserve the opportunity to demand reimbursement firmly. Give a polite reminder to the customer during the appropriate time and ask them to process it as soon as possible. The best accounting software or any online invoicing software will remind you about the amount receivable from the clients and send a reminder to the client on your behalf. Also, when dealing with private equity accounting, the new software needs to be able to handle complex calculations and regulations specific to the industry.

Your invoice information, tracking number, due time, and due date should all be included in your reminder letter. Please do not rush to arbitration because of a single unpaid payment. If you are ever not charged, keep a paper trail with all the reminders and invoices and battle your argument to get the money back.

7. Personalized templates for Invoices

This is a valuable method for more effective invoice management. This tends to give out invoices more professionally while still highlighting the business’s brand name. These invoices are simpler to construct and maintain. The invoice’s due date and other terms and conditions may be quickly included.

An online billing software comes with an in-built feature of creating professional invoices which reflect your business.

Last Thoughts

It can come as no surprise that companies need sales to thrive. As a result, making an efficient invoicing mechanism is a need rather than a desire.

You are incorrect if you believe that small companies should not use accounting tools such as invoice generator applications, Online invoicing software, POS billing software, etc.

According to a Statista survey, 64.4 percent of small business owners use Online Billing Software to handle their finances. So, if you’re searching for a dependable accounting solution, think about investing in good tech and the best accounting software for businesses in the market.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.