Borrowing is often a sign of adulthood. Adoption money isn’t fundamentally a symbol of bankruptcy. Almost everyone had a situation where you needed cash.

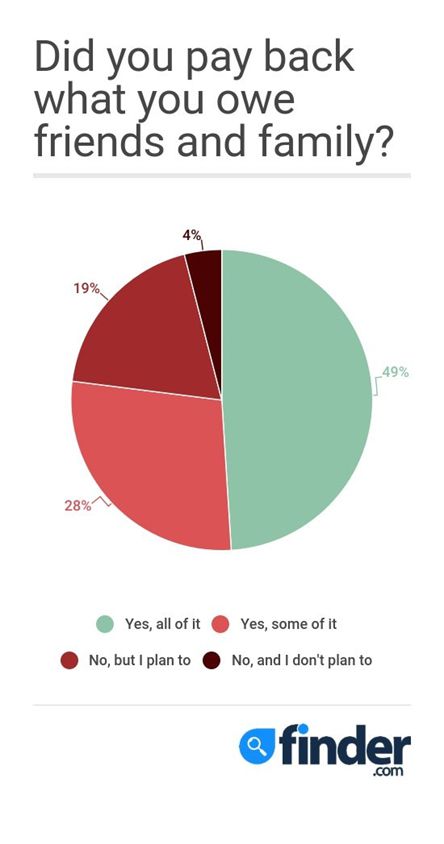

According to the survey of the 2020 year, the third part of people who borrowed or lent money from friends or family ended up with hurt feelings and resentment.

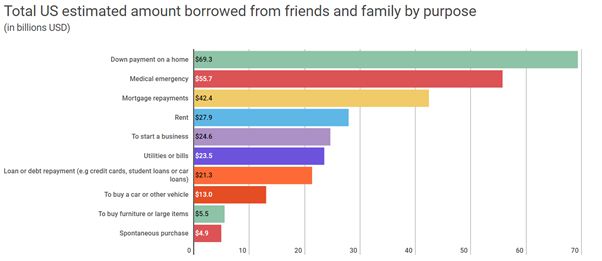

This could be related to the purchase of a house or car. Or maybe you need a cash advance for training. Or you want to start a business.

There can be a lot of reasons and whatever the reason you have to borrow cash. And many of people don’t have personal savings.

Borrowing money from friends is not always a good option. There are many ways to get cash nowadays, such as money borrowing apps. These apps that loan you money help you get a loan anywhere quickly and be more sensible with your cash.

You will no longer borrow from friends and family. Quick cash will become affordable for you. This is one of the most convenient ways to get additional funds for your personal needs.

Borrowing Money Definition

Defining money is the process of receiving cash with the intention of returning it after a certain period of time.

You could borrow cash if you want to buy an expensive item, for example, a new TV.

People usually take out loans to buy a house. They cannot save enough cash, that is why they take out a loan.

Borrowing Money from Friends

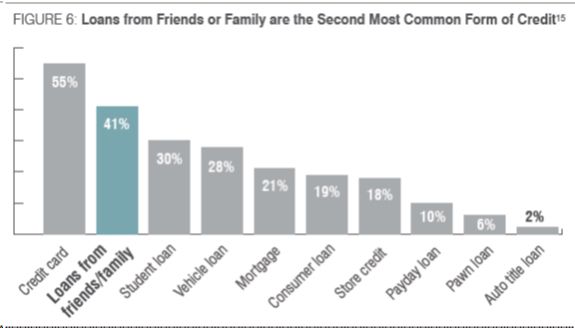

It seems that borrowing money from friends and family is easier and more flexible, than trying to get a bank advance.

But borrowing money from friends and don’t spoil the friendship is a great challenge

Before asking friends for a loan, think, this is the best idea. Do your best to ensure that money does not become a barrier in your friendship?

Be prepared for your friend to say no. Your friend may not be able to loan you as much money as you need or may worry that lending you cash will put your friendship at risk.

Whatever the reason, your friend has a right to turn you down. Try to have a backup plan for getting the money you need.

Borrowing money from friends is the best way to borrow a small amount of cash. You likely get more time to repay.

In this type of advance, the lender is likely to lose some interest income. Such borrowings are often finalized instantly over a cup of tea and are not documented.

Most likely, by borrowing money from friends, you will not receive a large amount, for example, to buy a car.

Therefore, we offer 4 ways of borrowing money.

#1 Money Borrowing Apps

The best option for a quick cash is money borrowing apps.With loan applications, you are borrowing money from a cash app without incurring the exorbitant fees that you see when issuing payday loans.

Loan applications are known today for making small advances. They provide instant cash.

Such money lending apps are the perfect app to get an advance in minutes. They have their pros and cons. This speedy cash app is not a direct personal loan lender, but a connecting service cooperating with direct pay advance lenders.

When you receive a loan, you undertake to pay not only the loan but also the interest accrued monthly on the amount of the debt.

You can get a loan anywhere thanks to online money borrowing. You do not have to stand in an endless line for borrowing, collecting a lot of documents.

Your money is on your phone. You can get a loan for any need at any time convenient for you.

#2 Credit Cards

Every time you use a credit card you are dealing with money.

Did you know that you can not only pay with a credit card but also borrow money?

If you are in need of a short-term receipt of a small amount of cash, then such a debt seems like a good idea.

Nobody charges you a percentage for filing an application – you already have a card.

But this option is not suitable for receiving a large amount for a long time. In this case, the interest rate will be very high.

#3 Loans from Banks

A bank loan is a personal borrowing you get from a bank, rather than an online lender or credit union. It can be issued by a large national bank or a smaller local bank.

Rates for personal loans from banks can start as low as 6%, and bank loan amounts can be as high as $100,000.

Before taking a loan from a bank, check how the loan works. What interest is charged by the bank? How will you get your money back? Immediately or monthly?

Choose a loan that you can handle, that you can repay and that won’t stop you from saving money for retirement or having fun with your friends.

Banks are a good place to get most types of loans. To apply for a loan, compare the interest rates of borrowing money online and directly at the bank.

#4 Borrow Money from Investment Companies

Financial courts are usually for people who want to buy any number of products. While banks provide long-term loans, most investment companies focus on providing money for small purchases.

They charge low-interest rates; besides, they work fast and have 24/7 support.

However, financing companies may not provide the same level of customer service or offer additional services, such as ATMs. They also tend to have a limited array of loans.

Whether you are looking for quick cash or a long-term loan, you should explore each of the borrowing options to find the most convenient for you.

If you’re feeling strapped for cash because of the coronavirus pandemic, you’re not alone.

Some lenders are offering help, and you may have some relief options for your mortgage, rent, or even utilities. If you’re worried about making your next auto loan payment or managing credit card debt or student loan debt, you may be eligible for financial relief during the coronavirus crisis.

If you’re worried about making your next auto loan payment or managing credit card debt or student loan debt, you may be eligible for financial relief during the coronavirus crisis.

Namaste UI collaborates closely with clients to develop tailored guest posting strategies that align with their unique goals and target audiences. Their commitment to delivering high-quality, niche-specific content ensures that each guest post not only meets but exceeds the expectations of both clients and the hosting platforms. Connect with us on social media for the latest updates on guest posting trends, outreach strategies, and digital marketing tips. For any types of guest posting services, contact us on info[at]namasteui.com.